Are you ready to conquer the Series 7 exam and pave your path to financial success? Look no further! With our comprehensive study guide and expert strategies, you can master this crucial test with ease.

From understanding key concepts to navigating the exam day, we’ve got you covered.

So, why wait? Sign up now and secure your ticket to a prosperous future in the financial industry. Don’t miss out on this opportunity to unlock your potential and achieve your goals!

Key Takeaways

- The Series 7 Exam is an important step towards unlocking career opportunities in the finance industry.

- Strategies for studying and preparing for the exam include active reading, practice questions, group study, and effective time management.

- The exam covers topics such as equity securities, debt securities, options, mutual funds, and customer accounts.

- Tips for navigating the exam day include prioritizing time, using test-taking strategies, and staying calm and focused.

The Importance of the Series 7 Exam

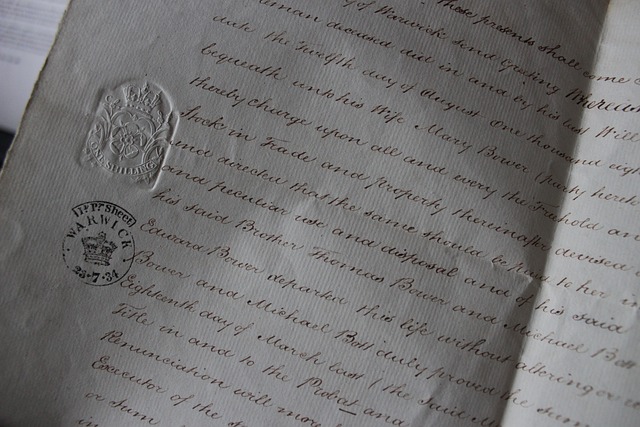

You need to understand the importance of the Series 7 exam if you want to achieve financial success. This exam is a crucial step towards unlocking various career opportunities in the finance industry. Whether you aspire to become a stockbroker, investment banker, or financial advisor, passing the Series 7 exam is essential.

The exam format and structure are designed to test your knowledge and understanding of securities regulations, investment products, and sales practices. It consists of 125 multiple-choice questions, which you must answer within a time limit of 225 minutes. The exam covers a wide range of topics, including equity securities, debt securities, options, mutual funds, and customer accounts.

By successfully completing the Series 7 exam, you demonstrate your competence and proficiency in these areas, making you a valuable asset to potential employers and clients. It signifies your commitment to professional development and showcases your ability to navigate the complex world of finance.

Therefore, investing time and effort into preparing for and passing the Series 7 exam is a critical step towards achieving your financial goals.

Strategies for Studying and Preparation

Get ahead in your studies by implementing effective strategies for studying and preparation. The Series 7 exam is a comprehensive and challenging test that requires careful planning and organization. By utilizing study techniques and practicing good time management, you can increase your chances of success. Here are some strategies to consider:

| Study Technique | Description | Benefits |

|---|---|---|

| Active Reading | Engage with the material by taking notes, highlighting key points, and summarizing information. | Enhances comprehension and retention. |

| Practice Questions | Test your knowledge and identify areas of weakness. | Improves understanding and builds confidence. |

| Group Study | Collaborate with peers to discuss concepts, ask questions, and share insights. | Promotes active learning and provides different perspectives. |

In addition to these study techniques, effective time management is crucial. Create a study schedule, set specific goals, and allocate dedicated time for studying. Avoid procrastination and prioritize your study sessions. Break down the material into manageable chunks and review regularly. By implementing these strategies and managing your time effectively, you will be well-prepared for the Series 7 exam.

Key Topics and Concepts Covered in the Exam

One of the key topics covered in the exam is effective time management. It is crucial to understand the exam format and structure in order to allocate your time efficiently.

The exam is divided into multiple sections, each focusing on different concepts and skills related to financial services. You will need to navigate through multiple-choice questions, as well as case studies and scenario-based questions.

To prepare for the exam, it is recommended to utilize study materials and resources provided by reputable sources. These may include textbooks, online courses, practice exams, and study guides. Taking advantage of these resources will help you familiarize yourself with the content and format of the exam, ensuring that you are well-prepared on test day.

Tips for Navigating the Exam Day

Navigating through the exam day can be made easier by following these tips.

-

Prioritize your time: Effective exam time management is crucial. Allocate more time to difficult questions and leave time at the end for review.

-

Use test taking strategies: Develop a systematic approach to tackle the exam. Read the questions carefully, eliminate obviously incorrect answers, and use process of elimination to narrow down choices.

-

Stay calm and focused: Anxiety can hinder your performance. Take deep breaths, stay positive, and maintain focus on the task at hand.

Unlocking Financial Success With a Series 7 Certification

Maximize your earning potential by unlocking the doors to financial success with a Series 7 certification.

In today’s competitive job market, having the right qualifications is crucial to stand out and thrive in the financial industry. Obtaining a Series 7 certification not only opens up a wide range of financial industry opportunities but also paves the way for career advancement.

This certification demonstrates your expertise in securities trading, making you a valuable asset to employers and clients alike. With a Series 7 certification, you gain the necessary knowledge and skills to navigate the complexities of the financial market, enabling you to make informed investment decisions and provide sound financial advice.

Don’t miss out on the chance to enhance your professional profile and unlock the potential for financial success. Start your journey today by enrolling in a Series 7 certification program.

Frequently Asked Questions

What Is the Passing Score for the Series 7 Exam?

The passing score for the Series 7 exam is 72%. To achieve this score, you must demonstrate a solid understanding of the financial industry and its regulations.

Before taking the exam, it is important to meet certain prerequisites, such as being sponsored by a FINRA member firm and completing the required coursework.

Are There Any Prerequisites or Qualifications Required to Take the Series 7 Exam?

Before you can pursue financial success through the Series 7 exam, let’s address the prerequisites and qualifications required.

To be eligible, you must be sponsored by a FINRA member firm and pass the Securities Industry Essentials (SIE) exam.

Additionally, there are no educational requirements, but a high school diploma or equivalent is recommended.

Meeting these qualifications will set you on the path to mastering the Series 7 exam and achieving your financial goals.

How Long Is the Series 7 Exam and How Many Questions Are on It?

The Series 7 exam duration is 225 minutes, or 3 hours and 45 minutes.

It consists of 125 multiple-choice questions.

This exam is designed to test your knowledge and understanding of securities industry rules and regulations, as well as various investment products and their risks.

It is important to thoroughly prepare for this exam to increase your chances of success.

Can the Series 7 Exam Be Taken Online or Does It Have to Be Taken in Person?

Can you take the Series 7 exam online or must you take it in person?

The Series 7 exam can be taken both online and in person, offering you options based on your preferences and circumstances.

Taking the exam online provides convenience and flexibility, allowing you to study at your own pace and in the comfort of your own space.

However, it’s important to consider potential drawbacks such as technical issues and distractions.

Ultimately, the choice between online and in-person exams depends on what works best for you.

How Long Does It Take to Receive the Series 7 Certification After Passing the Exam?

After passing the Series 7 exam, you may be wondering how long it takes to receive your certification.

The processing time for the Series 7 certification varies, but typically it can take a few weeks. During this post exam waiting period, the Financial Industry Regulatory Authority (FINRA) reviews your exam results and ensures all requirements are met.

Once the review is complete, you will receive your Series 7 certification, which is a significant step towards achieving financial success.

Conclusion

Congratulations! You’ve conquered the challenging Series 7 exam and now hold the key to financial success. By signing up and preparing for this exam, you’ve shown dedication and determination.

With your newfound certification, you’re ready to navigate the intricate world of finance. Remember, this is just the beginning of your journey towards financial freedom. Keep expanding your knowledge and expertise, and watch as your opportunities multiply.

Take pride in your accomplishment and prepare to prosper!