Ready to unlock your FINRA exam success? Look no further! In this article, we’ll show you how booking a convenient exam appointment can make all the difference.

With our expert tips and tricks, finding available slots will be a breeze.

Plus, we’ll guide you on maximizing your study time before your scheduled exam, and share dos and don’ts for making the most of your appointment.

Get ready to conquer your FINRA exam – book now!

Key Takeaways

- Scheduling your FINRA exam in advance allows flexibility and ample time for effective exam preparation strategies.

- Selecting a convenient exam time optimizes preparation, time management, and minimizes stress and distractions.

- Utilizing online scheduling platforms and checking for last-minute cancellations can help secure available appointment slots.

- Maximizing study time before the exam by prioritizing important topics, using study strategies, and implementing time management techniques.

The Importance of Scheduling Your FINRA Exam Appointment

Scheduling your FINRA exam appointment is crucial for ensuring a convenient and smooth testing experience. By booking your appointment in advance, you can take advantage of several scheduling advantages.

First, you have the flexibility to choose a date and time that works best for you, allowing you to plan your exam around your other commitments. Additionally, scheduling early gives you ample time to prepare and implement effective exam preparation strategies. You can create a study schedule, allocate time for practice exams, and review any challenging areas. This will help you feel more confident and prepared on the day of your exam.

Moreover, by scheduling your appointment in advance, you can avoid any last-minute rush or stress associated with finding available slots. Overall, taking the time to schedule your FINRA exam appointment early will greatly contribute to your success on the exam.

Benefits of Booking a Convenient Exam Time

Maximize your chances of success by selecting a time for your FINRA exam that suits your needs. When it comes to booking your exam, flexibility is key. By choosing a convenient exam time, you can effectively manage your time and optimize your preparation.

The benefits of booking a convenient exam time are numerous. Firstly, it allows you to schedule your study sessions in a way that aligns with your natural rhythm and peak productivity. This ensures that you are alert and focused during your exam.

Secondly, a convenient exam time allows you to take into account any personal or professional commitments you may have, minimizing stress and distractions.

Lastly, by selecting a time that suits your needs, you can approach the exam with confidence and peace of mind, knowing that you have done everything possible to set yourself up for success.

How to Find Available Appointment Slots for Your FINRA Exam

Finding available slots for your FINRA exam is made easier through the use of online scheduling platforms. These platforms provide you with the convenience and flexibility to find the perfect exam time that suits your schedule.

Here are some tips to help you find available appointment slots:

-

Check for cancellations: Keep an eye out for any last-minute cancellations. These openings can be quickly filled, allowing you to snag a spot that might otherwise be unavailable.

-

Utilize rescheduling options: If you are unable to find a suitable appointment initially, don’t worry. Many platforms offer rescheduling options, allowing you to change your exam time if a more convenient slot becomes available.

-

Plan ahead: Start searching for available slots well in advance. This will give you a better chance of finding the perfect exam time that aligns with your schedule.

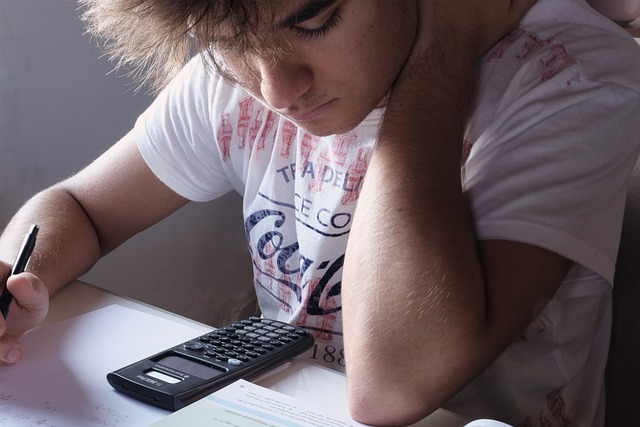

Tips for Maximizing Your Study Time Before Your Scheduled Exam

To make the most of your study time before your scheduled FINRA exam, prioritize important topics and create a study schedule that allows for focused and efficient learning. Start by identifying the key areas that you need to focus on and allocate more time to those topics. This will ensure that you cover all the necessary material and have a solid understanding of the concepts.

Next, create a study schedule that fits your personal preferences and commitments. It’s important to find a balance between studying and taking breaks to avoid burnout. Consider using study strategies such as active reading, summarizing information, and practicing with sample questions.

Additionally, practice time management techniques like setting specific goals, breaking down your study sessions into smaller tasks, and using timers to stay on track. By implementing these study strategies and managing your time effectively, you’ll be well-prepared for your FINRA exam.

Making the Most of Your Exam Appointment: Dos and Don’ts

When you arrive at your exam appointment, it’s important to be prepared with all the necessary identification and materials. To maximize efficiency and manage test anxiety, follow these dos and don’ts:

Dos:

- Arrive early to allow time for check-in and relaxation.

- Bring a valid ID and any required documents.

- Review your study materials one last time to boost confidence.

Don’ts:

- Don’t cram right before the exam, as it can increase stress levels.

- Avoid distractions, such as electronic devices or noisy environments.

- Don’t rush through the exam; take your time and read each question carefully.

By following these guidelines, you can make the most of your exam appointment. Being well-prepared and focused will help you perform at your best and alleviate any anxiety.

Remember to stay calm, trust your preparation, and tackle each question with confidence.

Frequently Asked Questions

How Long Does It Take to Receive the Results of the FINRA Exam?

To find out the finra exam processing time, you should expect to wait a few weeks for the results. Once you’ve completed the exam, the grading process will begin. During this time, your answers will be carefully reviewed and scored.

To prepare for the finra exam, make sure you study the relevant materials, practice with sample questions, and seek guidance from experienced professionals. This will help you increase your chances of success on the exam.

Can I Reschedule My FINRA Exam Appointment if Something Comes Up?

If something comes up and you need to reschedule your FINRA exam appointment, rest assured that there are options available to you.

The flexibility of the exam appointment allows for rescheduling if necessary. You can contact the appropriate authorities and make arrangements for a new appointment that suits your needs.

It’s important to have this flexibility to ensure that you can take your exam when you are fully prepared and ready to succeed.

Are There Any Additional Fees for Booking a Convenient Exam Time?

When booking a convenient exam time, it’s important to consider if there are any additional fees involved. You want to ensure that you’re not caught off guard with unexpected costs.

It’s always recommended to thoroughly review the terms and conditions before finalizing your appointment. This will give you a clear understanding of any potential fees that may be associated with booking a convenient exam time.

Can I Bring Any Personal Belongings Into the Exam Room?

You may wonder if you can bring any personal belongings into the exam room. It’s important to note that there are guidelines regarding what you can bring.

Typically, you are allowed to bring essential items such as identification, pens, and pencils. However, it’s best to check with the exam center for any specific rules or restrictions on personal belongings.

Ensuring you are well-prepared and informed about what you can bring will help you focus on your exam success.

What Happens if I Arrive Late to My Scheduled Exam Appointment?

If you arrive late to your scheduled exam appointment, there are penalties to consider.

FINRA has strict rules regarding punctuality, as they prioritize the integrity of the exam process.

You may be denied entry and have to reschedule your exam, incurring additional fees.

It is crucial to plan your arrival time carefully to avoid any setbacks.

Familiarize yourself with the rescheduling options available to ensure a smooth exam experience.

Conclusion

In conclusion, your journey towards FINRA exam success is like unlocking a hidden treasure. Just as a key opens a vault, scheduling a convenient appointment is the key to your success.

By booking an exam time that suits your needs, you are setting yourself up for a smooth and stress-free experience. Remember to make the most of your study time and follow the dos and don’ts during your appointment.

So, don’t wait any longer, book now and unlock the path to your financial future.