Are you ready to take your career to new heights? Look no further than a Finra exam registration.

By getting certified today, you can open doors to endless opportunities and skyrocket your professional growth. With Finra certification, you’ll establish yourself as a reputable and knowledgeable expert in the financial industry.

In this article, we’ll guide you through the steps to register for a Finra exam and share valuable tips to help you succeed.

So, buckle up and get ready to elevate your career to the next level.

Key Takeaways

- Boosts career prospects and increases chances of career growth

- Demonstrates commitment to professionalism and industry knowledge

- Provides industry recognition and a competitive edge

- Validates skills in securities trading, regulations, and ethics

The Importance of Finra Exam Registration for Career Growth

If you want to boost your career and increase your chances of career growth, it’s important that you get certified through Finra exam registration.

The importance of Finra exam registration for career advancement cannot be overstated. By obtaining this certification, you demonstrate your commitment to professionalism and industry knowledge, which can significantly enhance your career prospects.

Employers value individuals who have taken the initiative to obtain industry-recognized certifications, as it shows a dedication to continuous learning and staying up-to-date with the latest regulations and best practices.

Furthermore, Finra exam registration provides you with industry recognition, giving you a competitive edge over non-certified professionals in the field. This recognition can open doors to new opportunities, such as promotions, higher salaries, and increased responsibilities.

Investing in your professional development through Finra exam registration is a wise choice that can lead to long-term career success.

How Finra Certification Can Enhance Your Professional Reputation

Having a Finra certification can greatly improve your professional reputation. It demonstrates your commitment to professional development and showcases your expertise in the financial industry. By obtaining this certification, you gain industry recognition and stand out among your peers.

Here are a few reasons why Finra certification can enhance your professional reputation:

-

Validation of Skills: Finra certification confirms your knowledge and skills in areas such as securities trading, regulations, and ethics.

-

Credibility and Trust: Employers and clients value individuals with Finra certification, as it signifies a high level of competence and adherence to industry standards.

-

Career Advancement: With a Finra certification, you become eligible for more advanced roles and opportunities within the financial industry.

-

Networking Opportunities: Being part of the Finra certified community opens doors to networking events and connections with other professionals in the field.

Overall, a Finra certification demonstrates your commitment to continuous learning, industry expertise, and professional growth, leading to enhanced professional reputation and career prospects.

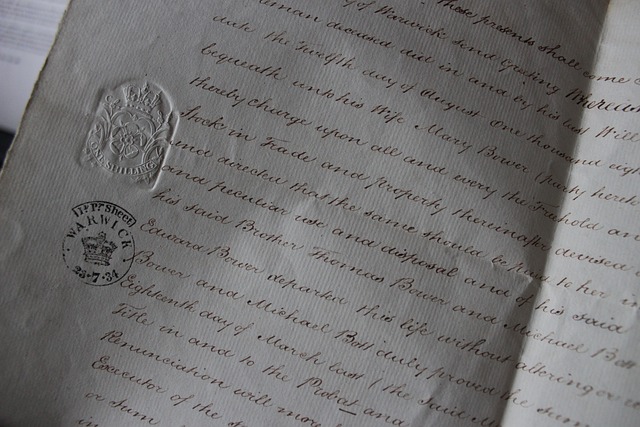

Steps to Register for a Finra Exam and Start Your Certification Journey

To begin your journey towards obtaining a Finra certification, you’ll want to start by registering for the exam.

The registration process is straightforward and can be done online. First, you’ll need to create an account on the Finra website. Once you’ve created your account, you can select the exam you wish to take and choose a convenient date and location.

After selecting your preferences, you’ll be prompted to pay the registration fee. It’s important to note that the fee varies depending on the exam you’re taking. Once your payment is processed, you’ll receive a confirmation email with further instructions.

With the registration process complete, you can now focus on preparing for the exam and embarking on the certification process.

The Benefits of Being Finra Certified in the Job Market

Enhance your job prospects by becoming Finra certified, as employers highly value this industry-recognized credential. Being Finra certified can open up doors to various job opportunities and potentially lead to a salary increase.

Here are some benefits of being Finra certified:

-

Increased credibility: Finra certification demonstrates your knowledge and expertise in the financial industry, making you a valuable asset to employers.

-

Expanded job opportunities: Many financial firms and institutions require Finra certification for certain positions, giving you an edge over other candidates.

-

Enhanced career progression: Being Finra certified can help you stand out among your peers and pave the way for promotions and advancement in your career.

-

Higher earning potential: With Finra certification, you may be eligible for higher-paying jobs and opportunities for bonuses and incentives.

Tips to Successfully Prepare for and Pass Your Finra Exam

Preparing for and passing your Finra exam can be made easier by following these helpful tips.

First and foremost, make sure you have the right study materials. The Finra exam covers a wide range of topics, so it’s crucial to have comprehensive study materials that cover all the necessary content. Look for reputable resources such as textbooks, online courses, and practice exams to help you prepare effectively.

In addition to having the right study materials, effective time management is key to success. Set aside dedicated study time each day and create a study schedule that allows you to cover all the exam topics thoroughly. Break down the content into smaller, manageable sections, and allocate specific time slots for each section. This will help you stay organized and ensure that you cover all the necessary material before the exam.

Frequently Asked Questions

Are There Any Prerequisites for Registering for a Finra Exam?

Before registering for a FINRA exam, it’s important to consider the prerequisites and exam requirements.

These are essential criteria that you need to meet in order to be eligible for the exam. Prerequisites typically include things like educational qualifications, work experience, and sponsorship by a FINRA member firm.

Exam requirements may involve completing specific training courses or passing certain exams before being allowed to take the FINRA exam.

Make sure you fulfill all the prerequisites and exam requirements before signing up.

Is There a Deadline for Registering for a Finra Exam?

There is a deadline for registering for a Finra exam, and it is important to be aware of it. By registering before the exam registration deadline, you can ensure that you have enough time to prepare and study for the exam.

This certification can greatly benefit your career as it demonstrates your knowledge and expertise in the financial industry. Getting certified through Finra can open up new opportunities and enhance your professional credibility.

How Long Does It Take to Receive the Finra Certification After Passing the Exam?

After passing the Finra exam, you might be wondering how long it takes to receive the certification. On average, the processing time for the Finra certification is about two to four weeks.

Once you receive your certification, it is valid for a period of two years. This certification can greatly boost your career prospects and open up new opportunities in the financial industry.

Can I Retake the Finra Exam if I Do Not Pass on the First Attempt?

If you do not pass the FINRA exam on your first attempt, you have the option to retake it. However, there are certain rules and limitations regarding retaking the exam.

You may need to wait a specified period of time before you can retake the exam, and there may be a limit on the number of times you can retake it.

It’s important to thoroughly prepare and study before retaking the exam to increase your chances of passing.

Are There Any Additional Costs Associated With Becoming Finra Certified?

When pursuing Finra certification, it’s essential to consider any additional costs that may be involved. One such cost is the exam fee, which is required to register for the exam. This fee covers the administration and evaluation of your test.

It’s important to factor in this expense when budgeting for your certification journey. However, it’s worth noting that the benefits of becoming Finra certified often far outweigh any initial financial investment.

Conclusion

So, you’ve come to the end of this article and now you’re probably thinking, ‘Wow, registering for a Finra exam is just the ticket to boost my career and get certified today!’

Well, isn’t that just the most ironic thing? Who would have thought that a simple registration could have such a profound impact on your professional reputation and job market value?

But hey, knowledge is power, and now that you’re armed with this information, you’re ready to take on the world and conquer that Finra exam.

Good luck!